With the COVID-19 pandemic still maintaining its hold on the United States, the virtual HRSA 340B audit is a reality for many covered entities. During our “Understand and Prepare for a Virtual HRSA Audit” webinar, Cervey’s Vice President of 340B Solutions Larry Crowder and Pharmacy Director of White River Medical Center, Maggie Williams come together to discuss ways to be prepared for this new audit format.

Missed the earlier Webinar Rewinds for “Understand and Prepare for a Virtual HRSA Audit?” Catch them here:

Part 1 | Part 2 | Part 3 | Part 4

28 Claims Chosen at Random

Larry Crowder:

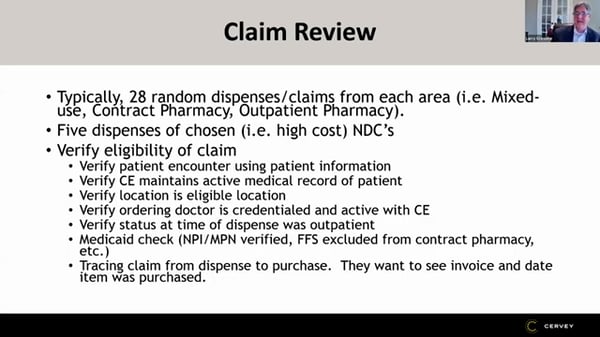

Finally, the claim review, and this is the part that I think has become really easy with the virtual audits, because again, they give you three business days to go through these and get your information together before they actually have the call with you. So, they’re typically going to choose about 28 random dispenses. They use a program, I think it’s called RAT-STATS.. I’m going to give you a little behind the scenes of what I’ve heard from an actual HRSA auditor. So, they take your mixed use area, for instance, that’s one universe. And they put in the number of claims that have come through in that six month period and it gives them back a random sample of those claims to choose.

Typically, it’s 28 random claims, but if you’re a small facility and you don’t have as many dispenses in that timeframe, that may be less than 28 claims. It just typically maxes out at 28 claims and most people get the 28 claims. The second thing they do, they do it for every 340B Universe. My understanding is that it is whatever universe has the most dispenses to it. Let’s say that you have 20 contract pharmacies, and they’re looking through more claims on the contract pharmacy universe than they are in your mixed use universe. Then they’re going to choose the contract pharmacy universe to pick five NBC’s of their choice.

5 High-Cost Dispenses

They’re going look at five dispenses and they’re just going to look based on price, high costs or some other method that they’re going to look at and say, this is one that I want to look personally at because it’s a high price drug, or it’s a drug that I know is typically a compliance issue. They choose those five and then they just do these steps. They verify the eligibility of the claim. So, they verify a patient encounter using the patient information. They verify that you have an active medical record of the patient, the location of the dispenses and eligible location, the doctor’s credentials, they verify the status with an outpatient at the time, then they do the Medicaid check.

Again, they’re going to look for the number that you provided in the file and compare that to the HRSA site. So, if you’re not providing both of those numbers, I would just register the one number of the HRSA site that you are providing. And then tracing that this is something that’s a little bit newer is they trace the claim from dispense to purchase.

They want to see okay, you dispensed it on July 12th when did that become part of a package that was ordered? And maybe it’s not been ordered yet, but it’s part of a package that’s currently accumulating to be ordered. And so now they want to see the invoice in date. If it was purchased on the 340, let’s say accumulated the 340B package, they want to see that invoice and date of when it was purchased.

Real-World Selections for Auditing

Maggie, what was your experience as far as actually doing the claims? How much of this did you actually see or is this all just, they were given to you and you saw the five claims that they chose?

Maggie Williams:

We got 61 samples and so when I broke it down, we had 28 mixed use, 25 from the clinic universe and only eight from our retail pharmacy universe. And we did have some high priced, I don’t know if it was five or how they decided, but we had CroFab, Krystexxa, IVIg. Those were a few that I remember that were on our sample lists that were definitely higher priced. We did not trace from the spits to purchase, but she might have, I don’t know, we had to submit all of our purchases ahead of time for that six month period. So, she could have done that. We just didn’t do it during the sample time.

Larry Crowder:

Basically, that’s five dispenses that they chose randomly. You don’t know where those fit in anywhere or where it came from necessarily, or do you know? It came from a specific area, like the Crow fab, I guess that would have been mixed use.

Maggie Williams:

That was mixed use. And then Orencia, Krystexxa, those were courses in our outpatient infusion center. And then we looked here again, pre-op is an outpatient clinic.

Larry Crowder:

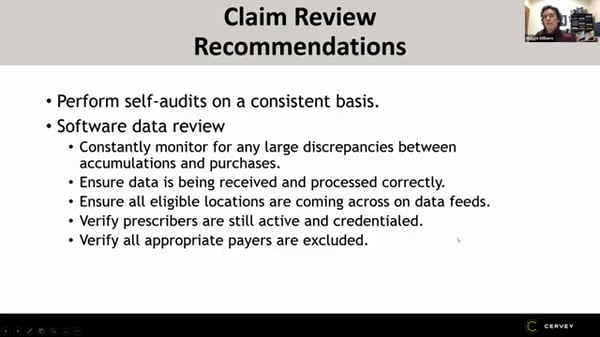

Our recommendations on this, obviously the self-audits are important. I know some of you wrote that you’re not currently doing your own self-internal audits. That’s really something that’s important because you’re going to be able to catch some of these things and how nice will it be if you catch it eight months before you get the HRSA letter, six months before you get the HRSA letter and you’ve already caught and fixed that. What happens a lot of times with accounts, if you’re not doing those internal self-audits on a consistent basis, when you get that audit letter and you start getting all the data, then you start thinking, Oh, what in this data could possibly get me in trouble? And that’s when you first start looking, that’s not the day you want to catch it. You want to catch it six months prior to that, or whenever it starts to occur.

I would constantly monitor for any large discrepancies. If you’re accumulating a bunch of something, but you’re not purchasing a lot of it, that could be a red flag or vice versa. If you’re purchasing a lot of something that you’re not accumulating, that could be an issue. You want to make sure that your data is being received and processed correctly. And this really generally falls under the 340B manager. Some of you I know are smaller facilities where people are doing multiple jobs. You might even have a buyer doing it, but you definitely want to be reviewing that data at least on a weekly basis, if you’re a small account. And then if you’re a larger account, you really need the resources to be put into to really review that data.

Ensure all those eligible locations are coming across the data feed. A lot of software has that location scrubbing where it’ll tell you whether or not something is a new location or it’s approved location. The prescribers we’ve said that about five times already the credential prescribers, those are very important. And then making sure that all your payers that should be excluded are excluded from any feed.

Larry Crowder:

Maggie has a list of things that she came up with that she wishes she would have known prior to being audited. Maggie, do you mind kind of going through those things that you found that you wish you said you had that pick three or four things?

Maggie Williams:

I would say the number one thing I would have done differently is once I got the sample list on that Thursday, they wanted the credentials of all of those physicians tied to those prescriptions on that sample list. I would have had that credential list pooled that was not clear in the explanation of what will be reviewed, but that was one of the items that took us awhile, was making sure we had all those physicians proof of credentialing. And then the other thing was pulling that universe, there’s 11 data points you have to pull per universe. And that is what took us a lot of time. If I would’ve done a mock audit beforehand, I would have known our deficiencies and what was hard for us to get out of our EMR.

Follow us to stay tuned for part 6 of the Webinar Rewind series for “Understand and Prepare for the Virtual HRSA Audit Experience” here:

Contact us for a demo of our 340B suite of web-based products that help 340B-eligible healthcare providers with three of their most pressing 340B needs: maximizing savings, ensuring compliance, and optimizing the performance of their contract pharmacies.

Looking for the rest of the webinar series? Check out parts 1-4 and 6 below: