The Pharmacy Benefit Management (PBM) industry is on a trajectory of remarkable growth, with projections indicating global revenues will reach $740 billion by 2029. Understanding the significant role PBMs play in the healthcare ecosystem is essential for stakeholders across the industry. This white paper delves into the current state of the PBM landscape, common criticisms faced by PBMs, and the imperative move towards transparency driven by recent legislative initiatives.

Current PBM Landscape

The PBM industry is currently dominated by three major players: CVS Caremark, Express Scripts, and Optum Rx. Together, these PBMs control over 80% of drug manufacturers’ rebate contracts, a system often involving offshore entities. Consequently, smaller PBMs receive as little as 40% of the manufacturer rebate payout, highlighting the significant market power and influence of the big three.

Common Criticisms of PBMs

Transparency is a critical issue in the PBM sector. Critics argue that the lack of transparency in rebate contracts and financial transactions undermines trust and may compromise patient care. Exclusive contracts with pharmacies and drug manufacturers, along with the creation of drug formularies and determination of medical necessity, raise concerns about undue influence within the drug supply chain. These practices have led to widespread calls for greater transparency and accountability.

A Move Towards Transparency

Recognizing the need for reform, the government has introduced significant legislation aimed at increasing transparency in the PBM industry. Two notable acts, the Pharmacy Benefit Reform Act (S. 1339) and the Pharmacy Benefit Manager Transparency Act of 2023, propose several key measures:

- Elimination of spread pricing and claw backs

- Requirement for 100% pass-through of rebates to the plan or payor

- Mandatory disclosure of drug costs and reimbursements

These legislative measures are designed to ensure that PBMs pass along rebates to employer groups and policyholders, fostering a more transparent and equitable system.

Transparency and Your Bottom Line

For retail pharmacy networks, transparency is not just beneficial; it is crucial. Key considerations include:

- Receiving all necessary data from your adjudication partner.

- Clarity on contracted rates and billing to employer groups.

- Assessing retail network performance across your business.

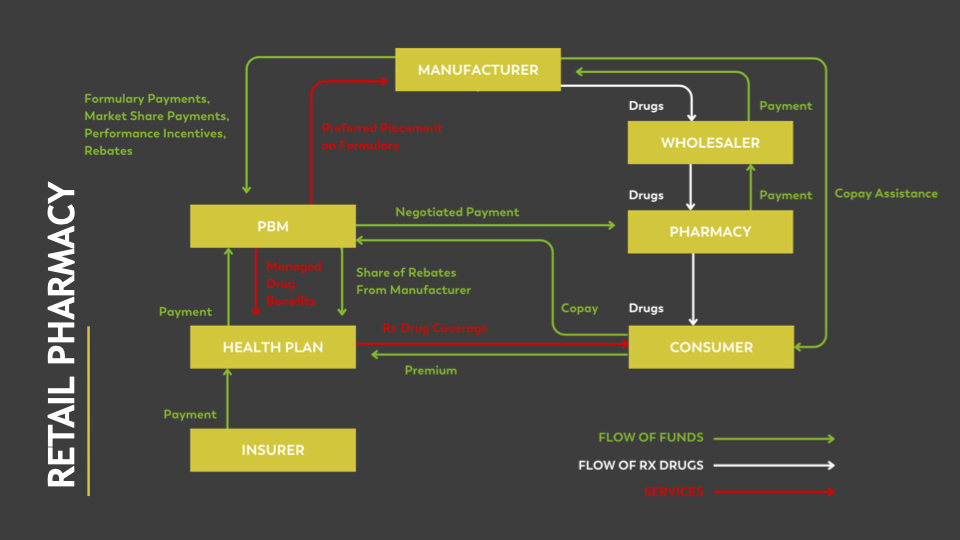

Visual 1: Flow of Funds in Retail Pharmacy

The following visual illustrates the flow of funds in the retail pharmacy sector, beginning with the consumer and moving through various entities such as the health plan, PBM, pharmacy, wholesaler, and manufacturer. This complex flow underscores the importance of visibility and transparency to accurately assess retail network operations.

Rebates and Transparency

Transparency is equally important for those managing rebates. Key questions to consider include:

- Does your rebate partner provide visibility into contracted rates and manufacturer fees?

- What percentage of rebates are you receiving?

- Is your adjudication partner providing the necessary data for your rebate model?

Understanding contracted rates and manufacturer fees is crucial for evaluating the financial health of the rebate program. Transparency ensures that there are no hidden costs or unexpected financial implications, enabling better financial planning and decision-making. Proposed legislation may impact average rebate guarantees, offering more choices and increased visibility into rebate distribution.

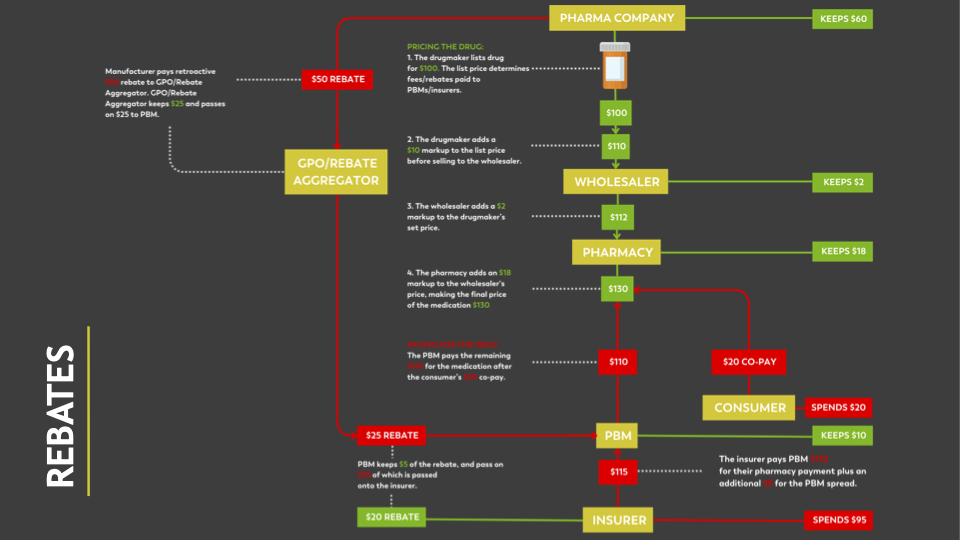

Visual 2: Flow of Drug Rebates

This visual representation highlights the flow of drug rebates through various entities, including insurers, Group Purchasing Organizations (GPOs) or rebate aggregators, PBMs, manufacturers, wholesalers, pharmacies, and consumers. The numerous hands involved in the rebate process underscore the necessity for transparency in rebate models.

Conclusion

Transparency in the PBM landscape is not just a buzzword; it is a fundamental aspect that impacts patient care and overall healthcare operations. As the industry moves towards greater openness, understanding the current landscape, staying informed about legislative changes, and ensuring partnerships built on trust will be key to long-term success.